By Robert A Emmanuel

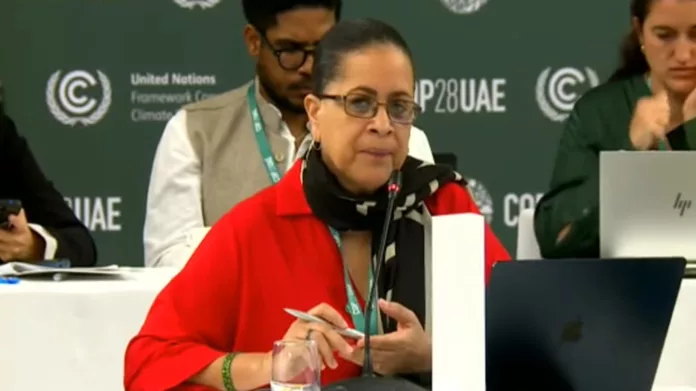

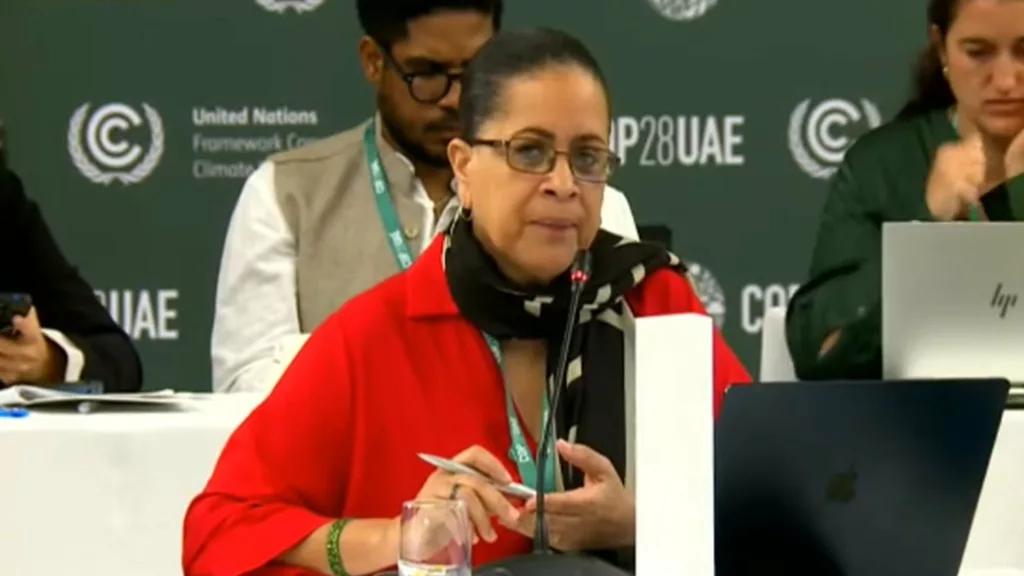

Chief Environment Officer Diann Black-Layne said while the preference of the Alliance of Small Island States (AOSIS) was to see a standalone Loss and Damage Fund, if certain conditions were applied, they would be willing to allow the World Bank to serve as the fund’s interim host.

The Ambassador was speaking at the fifth meeting of the Transitional Committee of the Loss and Damage Fund held in Abu Dhabi, United Arab Emirates—the host of this year’s UN climate summit, COP28.

The meeting, which continues Saturday, was to finalise the document which will serve to operationalise the fund prior to the start of COP28 on November 30.

The push for the World Bank—headquartered in Washington DC—to host the fund is being led by the US and EU.

However, the primary concern from developing states, activists and civil society over the World Bank hosting the fund was that it would “undermine the fund’s autonomy and restrict opportunities for direct access to resources for communities”, according to Lien Vandamme, a senior campaigner with the Centre for International Environmental Law.

Action Aid’s Head of Programmes and the civil society representative on the board of the Global Partnership for Education, David Archer, also expressed concerns.

“Being hosted by the World Bank is expensive and it erodes your independence and identity,” he wrote in an article.

Archer said even the recruitment of top posts to manage the Loss and Damage Fund would be dictated by the World Bank’s policies, further reducing the ability of the fund to extract itself.

Black-Layne told the meeting, “we are here to work with everybody but…there is a trust issue; but it is not only a trust issue, but the World Bank needs to be reformed”.

She explained, “For small island developing states (SIDS), if [reform] does not occur for whatever reason, then we will be locked into an organisation that have traditionally not wanted to work with us and so there is a lot of risk, especially for our small islands and small economies.”

According to the Chief Environment Officer, any assumption that the staff at the World Bank would be open to reform, reducing any power they have over certain funding programmes, would be a mistake, arguing that there should be a “tone” set by countries that will emphasise the need for reformation of the financial institution’s governance structure.

Wealthy nations, like the US, have historically been unwilling to accept primary responsibility for the widespread harm caused by the climate crisis.

The acquiescence of developing nations, including AOSIS, to the World Bank being interim hosts was considered a major win for the developed nations who have pushed back against the idea of a standalone entity.

However, Black-Layne said that the Loss and Damage Fund should be committed to supporting small island states in combatting climate change.

“It doesn’t make any difference for us to have a fund unless we have a strong allocation system… we are not prepared to agree to any fund that doesn’t have strong language that we will get the funds that we have,” Black-Layne emphasised.

“We have gone along in solidarity in the formation of the GCF [Green Climate Fund] and all the other funding arrangements and we still only get around two percent of the funds,” she added.

Established in 2010, the United Nations-led GCF takes donations from developed countries and uses the money to finance climate mitigation and adaptation projects in developing countries.

But expectations over the outcome of the GCF were described by Isabella Kaminski of Climate Home News as unrealistically high as “developing countries had anticipated it would provide a large amount of readily available grant funding, while developed countries had wanted it to massively leverage private sector funding and thereby reduce their own financial liabilities”.