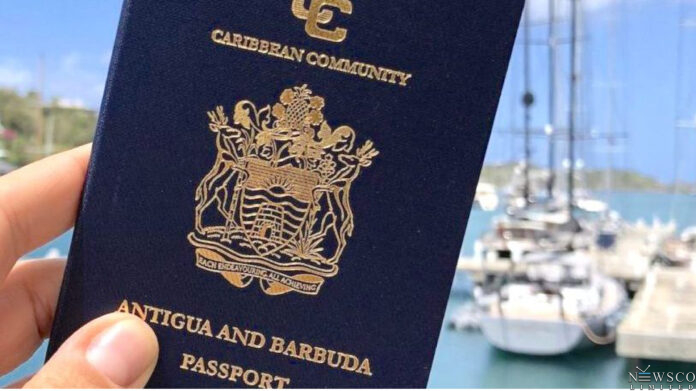

Antigua and Barbuda has secured the third spot, alongside two other Caribbean islands, for its Citizenship by Investment Programme (CIP).

The rankings for most important CIP programmes were revealed by Henley & Partners in their 2024 Global Citizenship Program Index, which evaluates various aspects such as quality of life, visa-free travel, investment prerequisites, compliance measures, residency requirements, relocation flexibility, transparency, and reputation.

Henley & Partners, renowned for their expertise in the sector, unveiled the top performers in this arena.

Malta nabbed the top position, with Austria following closely behind. Antigua and Barbuda, Grenada, and St Lucia jointly occupied the third position.

Prime Minister Gaston Browne expressed pride in Antigua’s achievement, saying, “We operate the most robust and transparent CIP in the Caribbean and beyond.”

The report highlights Malta as the leading alternative citizenship solution due to its “robust and transparent regulated citizenship process”.

Malta’s scheme entails a 36-month (or, exceptionally, 12-month) residence period and a minimum investment of EUR 738,000 (US$788K). This investment covers real estate acquisition or rental, and a donation to a non-governmental organisation supporting the local community.

The advantages of Maltese citizenship include “access to a reputable financial centre and a prime jurisdiction for international business, a high quality of life, and, perhaps most importantly, the global mobility that Maltese passport holders enjoy”.

Antigua and Barbuda’s CIP earned recognition for its “accessible investment requirement of US$100,000 for the donation route”.

“Notably, another attractive feature of this programme is that successful applicants are only required to visit the islands for five days during the first five years of obtaining citizenship,” the report added.

It went on to say that the twin island nation also “offers a favourable tax environment with no taxes applied to capital gains, wealth, or inheritance”.

It adds, “In addition, Antigua and Barbuda unlocks a plethora of international mobility benefits for global businesspeople as its passport holders can travel freely to over 150 destinations around the world.

“Investors from countries with a lower passport ranking can therefore leverage Antigua and Barbuda’s citizenship programme to gain visa-free access to a larger proportion of the world’s business hubs.”