Budget presentation unveils increases to alcohol, money transfer fees and property tax

By Gemma Handy

A ream of heftier taxes to be implemented next year will hit consumers in the pocket as government battles to bolster public coffers.

Drinkers and smokers will be stung with a 10 percent excise tax on alcohol and tobacco; the levy will also include cannabis products.

Excise taxes are paid by businesses and usually result in higher prices being passed onto customers. Taxes on cigarettes and liquor have traditionally been kept to a minimum by the government to discourage smuggling.

Many people – such as foreign workers whose families back home rely on remittances – will also feel the effects of a significant hike in the money transfer levy. That will more than double from two percent to five percent.

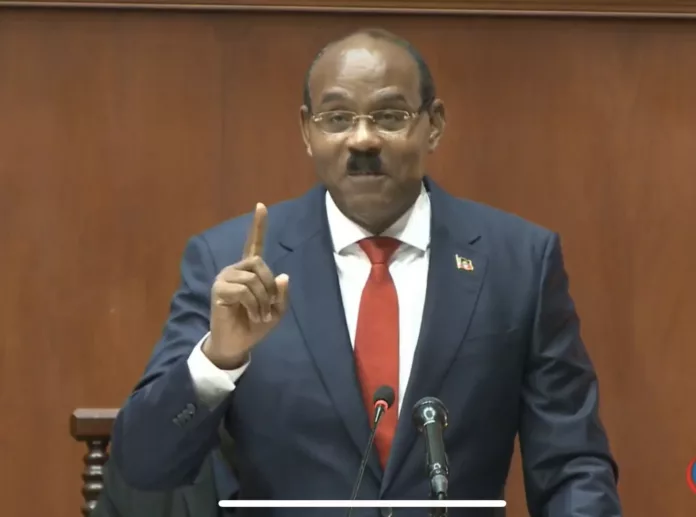

The impending measures were unveiled in yesterday’s budget speech delivered to Parliament by the Prime Minister.

A forthcoming hike in the sales tax ABST from 15 percent to 17 percent had already been broadly publicised prior to Friday’s presentation. The ensuing controversy saw a protest outside Parliament before the session began by opposition party members and supporters brandishing placards.

PM Gaston Browne yesterday revealed the new ABST rate would also apply to the tourism sector which had previously enjoyed a lower rate of 14 percent.

Government also intends to widen the list of services to which ABST applies – including online streaming services.

Homeowners with properties worth EC$3 million or more will have been disappointed to learn that a previously touted hike in luxury property tax will indeed jump from 0.3 to 0.5 percent in 2024.

Discretionary tax concessions enjoyed by various local businesses will also be axed for “routine operations” such as consumables, the PM said.

Friday’s budget presentation came just nine months after the last one. Browne, who is also Finance Minister, delivered a strident speech abundant with superlatives and self-congratulation.

There were undoubtedly reasons to be cheerful with the overall fiscal deficit – the gap between what government earns and what it spends – narrowing to 2.7 percent of GDP. The EC$155.8 million deficit is a marked improvement on 2022’s figure of EC$197.8 million.

Browne was also quick to state that Antigua and Barbuda has the lowest tax to GDP ratio in the region, while the country’s current EC$13.99 per gallon gas price is the lowest in the Eastern Caribbean Currency Union.

Economic growth this year dipped to 8.1 percent, compared to 9.5 percent last year and 8.2 percent in 2021, but the twin island nation’s “spectacular” outlook remains second only in the region to oil-rich Guyana, the PM said.

Public sector debt has seen a reduction in the debt to GDP ratio from 75 percent in 2022 to 66 percent in 2023 – but still lingers at an eye-watering EC$3.8 billion.

Browne also listed the allocations for the eight government ministries which collectively amount to EC$814.2 million – an increase from the EC$760.7 million in the March presentation.

The Barbuda Council was among the biggest winners with a massive chunk of extra change. The sister isle’s governing body has been earmarked EC$9.5 million for next year, compared to this year’s EC$6.5 million.

The Ministry of Education, Sport and Creative Industries will again receive the biggest allocation of all with EC$184.2 million, a slight dip on the last budget’s EC$185 million.

The Ministry of Health, Wellness, Social Transformation and the Environment will receive EC$160.5 million, an increase on the previous EC$147 million.

A total of EC$114.6 million has been set aside for the Ministry of Housing, Works, Lands and Urban Renewal – a jump on March’s budgetary figure of EC$97.6 million.

The Attorney General’s Office and Ministry of Legal Affairs, Public Safety, Immigration and Labour will get EC$114.4 million, compared to its erstwhile EC$106.3 million.

The Ministry of Foreign Affairs, Agriculture, Trade and Barbuda Affairs will see EC$52.7 million, a hike on the previous EC$50.1 million allotted.

The Ministry of Tourism, Civil Aviation, Transportation and Investment – with EC$37.6 million next year – will have a slightly smaller slice of the pie than its previous EC$38.3 million.

And the Ministry of Information Communication Technologies, Utilities and Energy’s allocation remains unchanged at EC$15.3 million.

The Prime Minister also awarded his Office a significant increase from EC$36.7 million to EC$42.7 million, while the Ministry of Finance, Corporate Governance and Public Private Partnerships will get EC$134.9 million, up from EC$121.1 million. The Barbuda Council’s funds come from the latter allotment.

Meanwhile, debate over the most equitable methods of taxation will likely continue to rage. Many remain vehemently opposed to consumption taxes saying they hit the poorest the hardest.

Personal income tax – introduced by the UPP in 2004 – was abolished by the Labour Party in April 2016. And yesterday PM Browne said he remained “resolute” in keeping it confined to the past.

“This principle is more than a fiscal strategy; it embodies a steadfast belief in empowering our citizens to determine the destiny of their financial resources,” he said, adding that axing income tax had left local residents with more disposable income, thereby fuelling investment and entrepreneurship.

One thing seems fairly certain: Browne’s presentation will likely see fireworks and polemics on Tuesday when MPs return to Parliament for the budget debate.