By Elesha George

Business continued as usual at both of the former Bank of Nova Scotia (BNS) branches on Wednesday, but its High Street branch was noticeably decked out in the signature colours and logo of the Eastern Caribbean Amalgamated Bank (ECAB).

This signalled the first day of ECAB’s legal ownership of the Canadian bank, a decade after the indigenous bank began operations in the country.

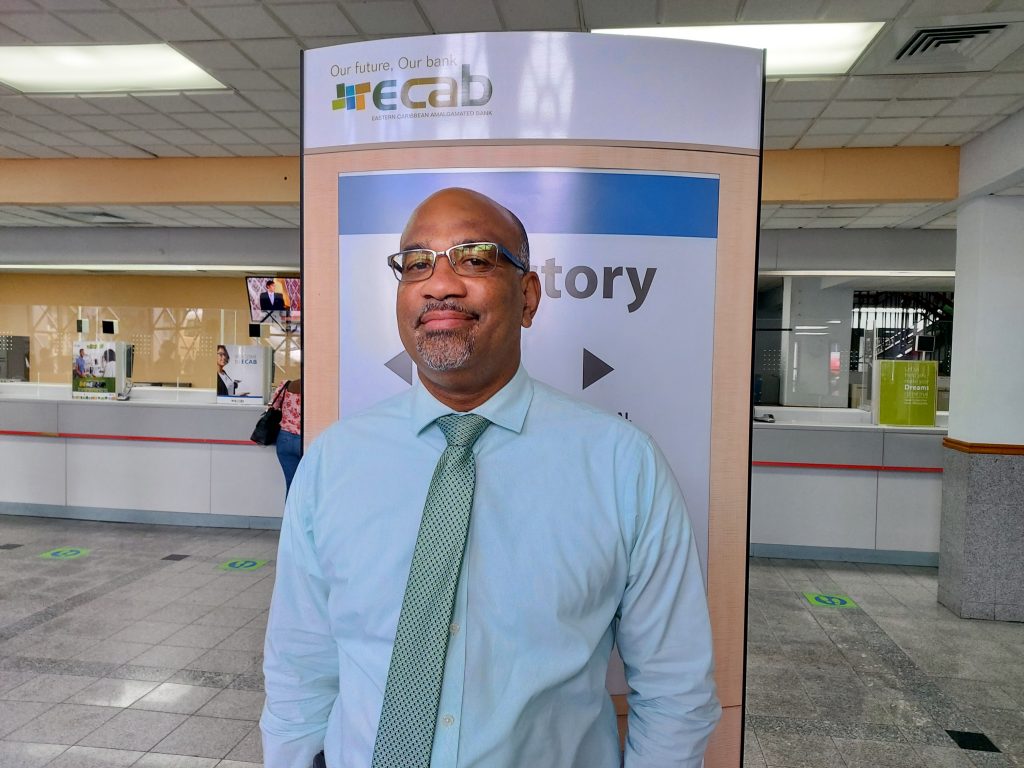

ECAB’s General Manager, Michael Spencer, said he and his team were thrilled to arrive at this point after a long process. The transaction was finally closed on Tuesday evening.

“I think the teams have been excited thus far but this is just day one so we have a long time to go and we expect that the teams will be involved as we plan the integration of the assets on to the ECAB platform,” he told Observer.

After more than 60 years of operation in the Caribbean, in 2019 Trinidad-based Republic Financial Holdings Limited (RFHL) formally acquired Scotiabank’s operations in Anguilla, Dominica, Grenada, St Kitts and Nevis, St Lucia, St Maarten, and St Vincent and the Grenadines.

Antigua and Barbuda was also expected to be part of the acquisition. However, Prime Minister Gaston Browne refused to issue the vesting order under the former terms of agreement and without initial consultation with his government. He insisted that local banks be given the first right of refusal in the Canadian bank’s sale.

This week’s completion of that sale is the result of at least two years of negotiation. The parties had to get a better understanding of the business and make the necessary applications to the regulatory bodies for approval.

“We are now going to be going through a process to integrate all of the BNS accounts on to ECAB’s platforms,” Spencer said.

Persons who have accounts with Scotiabank as well as ECAB will have the opportunity to decide whether they want to keep both accounts open. The transition to that point is anticipated to take another 12 months.

“Once we’ve converted all of the customers to the ECAB systems, all of ECAB’s customers can utilise branches on either side and that is going to be another benefit for customers as part of this transaction,” he noted.

For now, Spencer said there will be no changes to banking arrangements and former customers of Scotiabank will continue to have access to their accounts at the various locations.

The terms and conditions of credit cards, loans and interest rates will eventually be transferred over to ECAB.

“You will continue to utilise your existing cards until either expiry or until a date has been determined to replace them with ECAB branded plastic cards. The intention and plan is for all of the BNS debit and credit cards to be changed over to ECAB’s new suite of credit cards,” he explained.

The acquisition now brings ECAB from four to six branches and from 11 to 23 automated machines island wide.